Tax Relief On Workplace Pension Schemes

A common question from employees is how the tax relief they receive on workplace pension contributions affects them and how it is calculated. We explore the 3 main pension contribution options and their different rules.

Pension contributions are important as they are a tax efficient way of saving for retirement - the government effectively adds money to any pension savings we make, by way of tax relief, to incentivise us to build a pot we can draw down on in later life. Doing this at an early stage in our careers is particularly beneficial as pension schemes invest our money in order to (hopefully!) make gains. The compounding of these gains and contributions over time is what really impacts our final pension figure.

But how is this tax relief calculated and what is the affect on mine or my employees net pay, I hear you ask…there are 3 primary methods of contributing as an employee:

Relief at Source

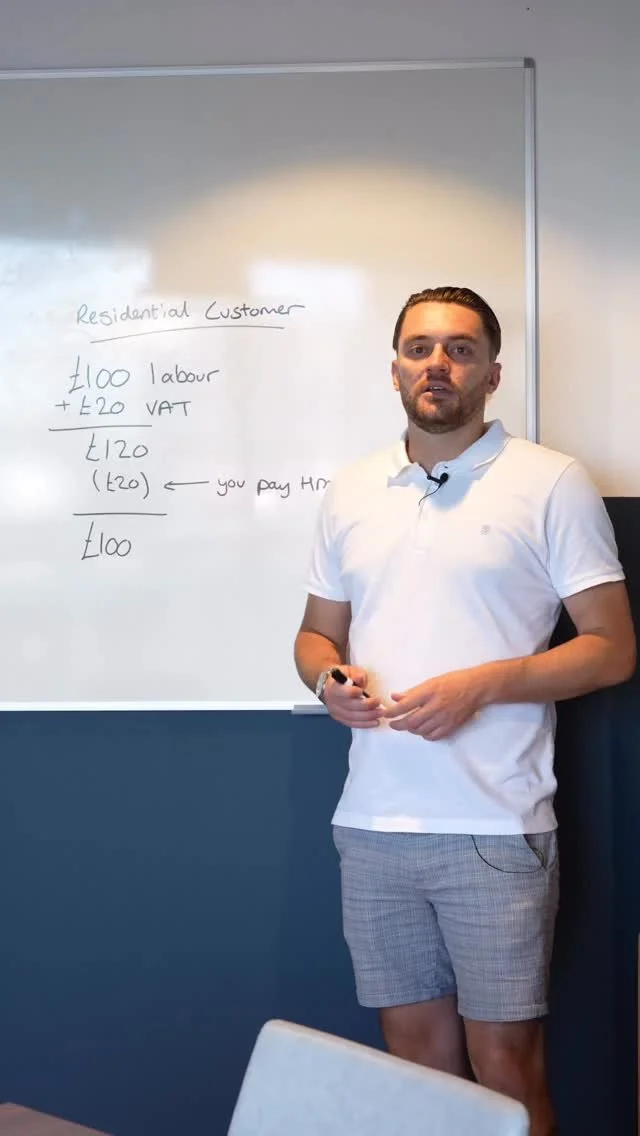

The employee pays their pension contribution into the pension plan from their net pay after tax, national insurance and student loan, and the pension provider claims basic rate tax relief from the government on behalf of the employee. The pension provider adds the tax relief to the contribution and the employee benefits from this additional amount in their pension plan. Higher rate taxpayers should claim additional tax relief through their self-assessment tax return.

Net Pay Arrangement

The pension contribution is deducted from the employee's gross pay before tax is calculated, but after national insurance and student loan repayments. The employee receives tax relief at their highest marginal rate, but both the employer and employee pay national insurance contributions on the pension contributions made.

Salary Sacrifice

The employee agrees to reduce their salary by a certain amount, which is then paid into their pension plan. The employee does not pay income tax or national insurance contributions (NICs) on the amount they sacrifice and student loan repayments are calculated after the sacrificed amount. The employer benefits from reduced NICs, which can be passed on to the employee as an increased contribution to their pension, subject to the employers agreement.

Choosing which contribution method is best for yourself or the employees in your business depends on various factors, such as the employees tax situations, the employers policies and your chosen pension plan options. As an employer, there can be different costs associated with administering each pension plan, so it is important to discuss with an Independent Financial Adviser as well as your accountant to determine what is best for your business and your employees.

Please note the above material does not constitute advice in any way. The blog has been provided for informational purposes only and should not be relied on for tax, legal or accounting advice. You should consult with your own accountant, or financial advisor, before engaging in any transaction, or alternatively contact us directly.

More articles

Like what you see here? Here is some more great accounting advice.